Ask AI on The Internet

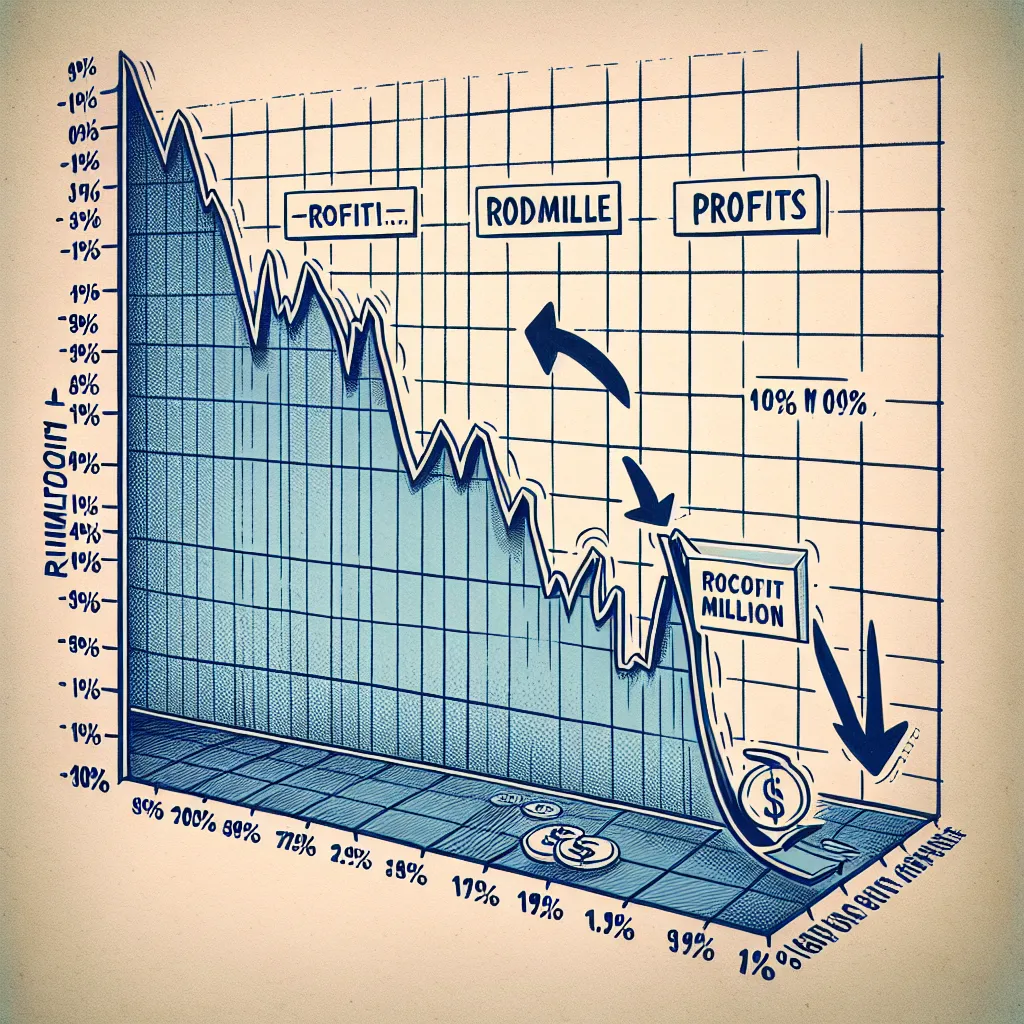

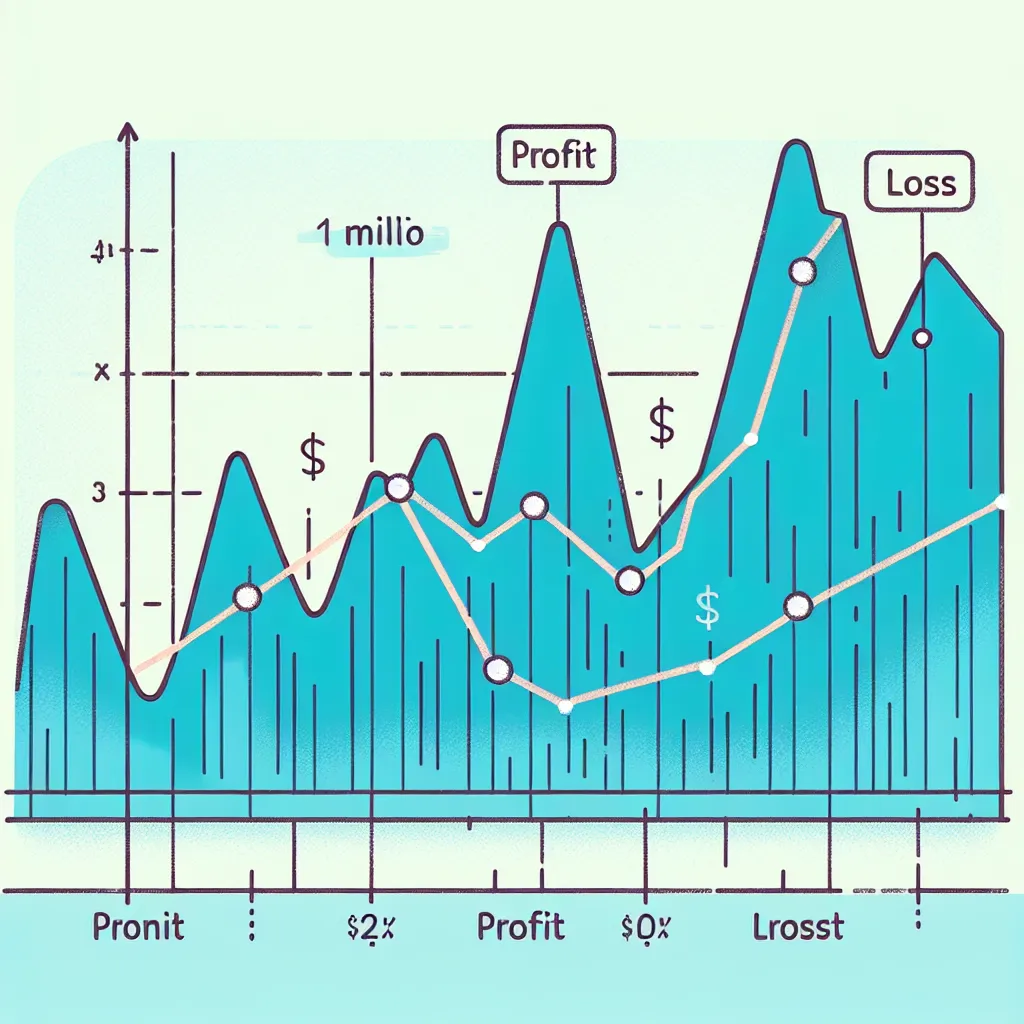

Question: True or false? A company making $1 million profit after expenses one quarter that loses $1 million the next quarter has seen a 200% decrease in profits.

False. To determine the percentage decrease in profits, you need to look at the change relative to the initial amount. The initial profit was $1 million, and in the next quarter, the profit was -$1 million (a loss of $1 million). The change in profit is: \[ -\$1,000,000 - \$1,000,000 = -\$2,000,000 \] To calculate the percentage decrease: \[ \frac{\text{Change in profit}}{\text{Initial profit}} \times 100 = \frac{-\$2,000,000}{\$1,000,000} \times 100 = -200\% \] However, this does not mean the company saw a 200% decrease in profits, because the term generally used here refers explicitly to how much profit decreased relative to the initial amount. A 100% decrease would mean the profit dropped to $0, and dropping to negative values means the business is now incurring losses, not just a decrease. So, while technically the calculation is correct, it's more precise to say that the profit decreased to a loss of \$1 million, rather than just using the term 200% decrease.

Think your answer is better than the AI's? Post it below.

Question Tags

If you want your question answered by an AI, click here.

Post your own comment: